Proximilar's AI beats human competitors

Our AI has beaten the Wall Street consensus for large & mid-cap US companies nearly 70% of the time in recent quarters. Moreover, compared to analysts’ estimates, Proximilar’s percentage errors are almost 30% lower.

Proximilar's EPS Win Rate vs. Analyst Consensus (% of Stocks)

No Data Found

Proximilar's Revenue Win Rate vs. Analyst Consensus (% of Stocks)

No Data Found

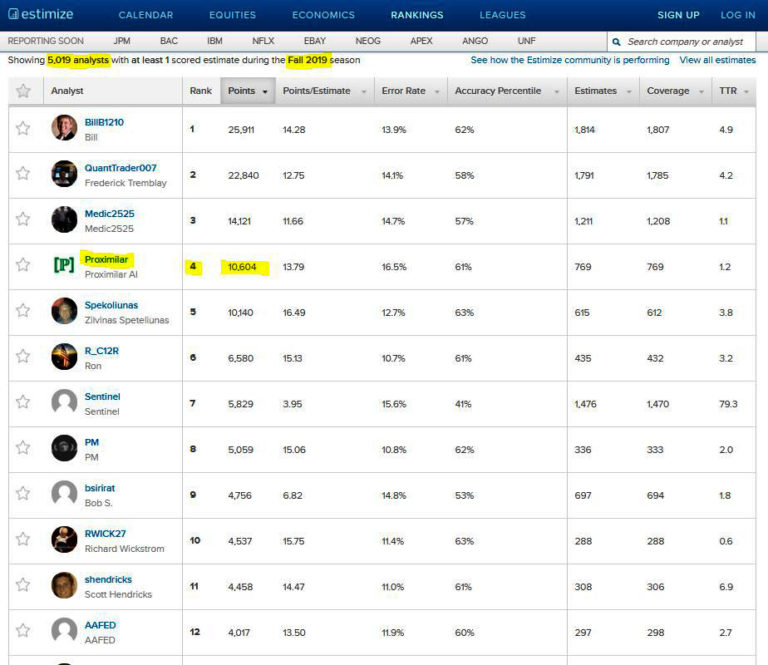

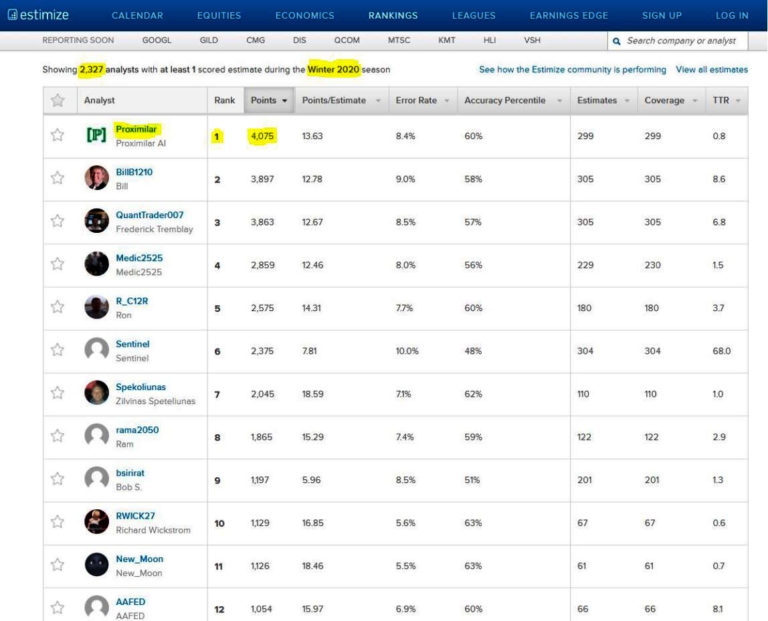

In early November 2019 we entered a forecasting tournament on a leading online platform for competitive EPS and revenue prediction.

By the end of 2019 we ranked #4 out of over 5000 analysts. We achieved this success despite our late entry into the competition (our models were finalized in November 2019, when most companies already announced Q3 results).

Proximilar’s predictions received the site’s highest confidence ratings, in effect making us its MVP.

How Proximilar Makes Its Forecasts

For each indicator that we forecast — earnings, revenues, stock price moves, etc. — Proximilar trains an “ensemble” of dozens of AI models using a vast dataset we built in-house. Like people, AI models learn from past examples. Think of each model in our ensemble as a living person — a continually learning analyst with his/her own independent perspective and decades of experience. When brought together, these “analysts” make better decisions than each of them could on their own.

Training models requires a huge amount of data! The dataset we use covers every company in the US and gets updated daily. It incorporates multiple decades of historical information about every aspect of company financials, trading history, market environment, economic data and many other factors. We identify the most relevant variables and meticulously distill the data into the form AI can learn from.

To make sure our models do not just memorize the data we show them, but really learn the “rules” of finance, we use a mathematical trick: every time we train a model, we hide some data from it. At the end of training we use this withheld data as the model’s final exam. Only the best performers on that exam are allowed to graduate into production.

Once our state-of-the-art AI models are trained and tested, we put them to work. Every day we give them fresh data, and they make predictions about what’s likely to happen next.

Why our AI forecasts do better

Artificial intelligence regularly beats world champions at the games of chess and go. It has gotten incredibly good at games involving uncertainty, like poker. Why should corporate finance be any different?

Lots of smart analysts work on Wall Street, but they are only human:

- They cannot keep track of the myriad factors that affect companies’ performance.

- Their expertise is usually limited to one industry.

- Their bandwidth is constrained, especially since staff cuts force them to cover more companies than ever.

- Cognitive biases make them place too much weight on recent events and ignore information that clashes with their existing beliefs.

- They have conflicts of interest.

None of the issues that plague human analysts are a problem for machines. Tireless, unbiased, with nearly unlimited computational capacity and memory, Proximilar’s AI cuts through randomness and complexity to gain deeper insights than people ever could. Our AI lays bare the analysts’ errors and translates them into new opportunities for our clients.

If you are serious about investing, you know how high the cost of not having the best information can be. After all, avoiding bad trades is just as important as making good ones. Understanding the potential upside / downside of an earnings release can be the difference between a successful quarter and a quarter you’d rather forget.

Proximilar arms you to do both: to take advantage of the opportunity and to protect yourself from risk.

No rumors — only science

Sometimes people ask us if our forecasts are similar to whisper numbers. The answer is a resounding No. Earnings whisper numbers are, at best, a few anonymous people’s opinions. Depending on who decides to respond to a given survey, its output might be credible — or just a rumor.

There is a big difference between these rough and subjective expectations and our AI’s objective assessment of what is likely to happen.

Best estimates of post-announcement moves

Earnings releases are usually followed by the most volatile day of the quarter, with 10-15 days’ worth of volatility often packed into a single morning. Knowing how much you are risking on one stock’s earnings announcement is absolutely essential.

In the past, investors often used volatility levels implied by options prices to predict the magnitude of risk in post-earnings moves. Тhere are several problems with this approach. First of all, for most US stocks there are simply no sufficiently liquid options. Second, options prices are often driven by dealer positioning, customer flow and sentiment. To complicate things, option expiries do not line up with earnings announcement dates. And for many companies, announcement dates are not even known in advance with enough accuracy.

Our AI’s predictions about the magnitude of the post-release price moves are not affected by any of these factors. For some liquid stocks we see option implied forecasts similar to our AI’s prediction, but in many cases the two approaches yield different results.