Last week, in our post about earnings straddles we used the example of Tesla (TSLA) to illustrate how you can take advantage of AI’s post-earnings move forecasts. Now let’s use the same approach to reveal the opportunities that hundreds of announcements expected this week have to offer.

As before, we will be using Proximilar’s forecast spreadsheet (get it with the green button above). The most liquid stocks will be near the top of the sheet. Once again we will focus on Column L (“Overnight move”) that tells us how much volatility — whether to the upside or downside — our AI expects right after the announcement.

Two data sources, side-by-side

To put the AI’s move predictions into context, we put them side-by-side with the move sizes that current option prices imply, a.k.a. “option implied moves.” This gives us two independent ways of looking at the same question.

(As before, we define the option implied move as the earnings risk premium of a short-dated at-the-money straddle position. Online brokers offer analytical tools that will compute this risk premium for you. A straddle is a combination of a long put and a long call with the same strike price and expiry date.)

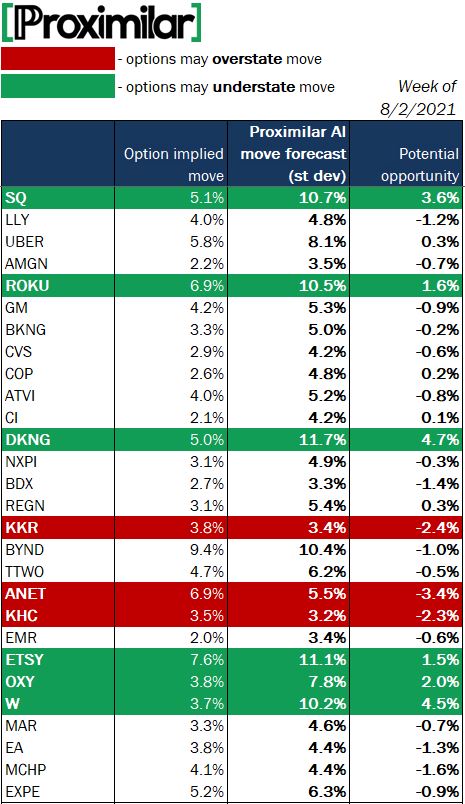

As a result, we get the following table (this is only the top part of it).

If the option implied move is a lot lower than the AI forecast, this may indicate that the implied volatility is too cheap, i.e., this is an options buying opportunity. And vice versa if the option implied move is above our AI’s estimate: this would suggest the vol is too expensive.

Visualization is key

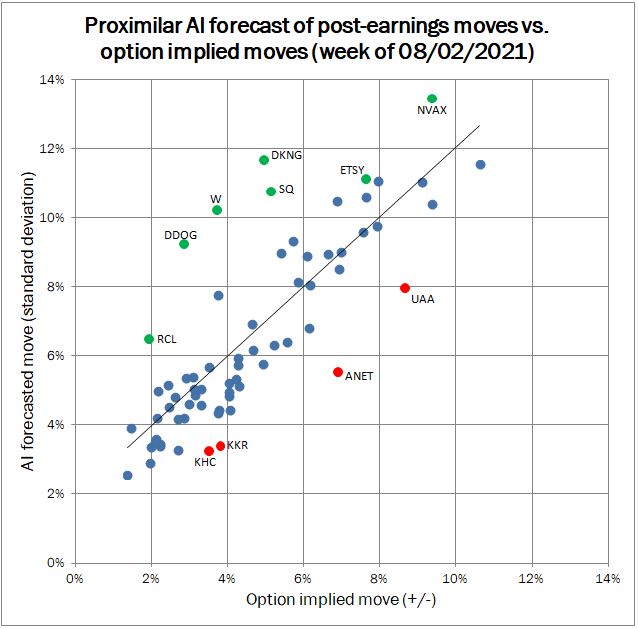

We can visualize opportunities by plotting the values from the table on a graph. Let’s mark the points of biggest disagreement between our AI & the options market in green and red:

Here we can see that for several stocks the market may underestimate the earnings volatility, at times by a lot. Among these are Square (SQ), Roku (ROKU), Draftkings (DKNG), Etsy (ETSY), Penn National Gaming (PENN), Wayfair (W), Novavax (NVAX), Datadog (DDOG) and Royal Caribbean Cruises (RCL).

On the other hand, options prices seem to overstate the potential earnings moves for names like KKR & Co (KKR), Arista Networks (ANET), Kraft Heinz (KHC) and Under Armour (UAA).

For seasoned investors who have the necessary experience our earnings moves forecasts provide compelling opportunities. We update our forecasts every week enabling you to test this and other strategies for thousands of stocks every quarter.

Happy trading!